We all know the cliché that location sells, but just as important in this market has been the quality of housing stock. With the cost building materials on an upward spiral over the last couple of years and longer waits for the availability of skilled tradesmen, many buyers have thought twice about taking on projects and we have found that ‘turnkey’ properties have proved increasingly popular. The case for a combination of the right location and good quality homes has therefore become a compelling one.

One such example was Field House in Barkers Hill, Semley. The owners had been known to us for many years and we had been fortunate enough to have sold properties for them before, so we knew what to expect when we arrived for our initial visit.

Field House was not a large property. It was under 2,000 sq ft, only had three bedrooms and the sitting room and kitchen were of a relatively modest size, but this particular house was a little gem.

“You were super helpful and efficient when selling our Dorset cottage. Thank you! Would highly recommend Rural View.” LK 2023

The property had been acquired some eight years previously, very much as a project and needing plenty of vision. The result was just dazzling. The clever thing about Field House was that everything about it complemented in an immaculate style that every single viewer simply fell for. It wasn’t over the top or glitzy, just very, very fine and it was a joy to sell.

The attention to detail was intrinsic to the product, from colour selection and soft furnishings to fittings and layout, but perhaps what gave buyers the most confidence on arrival was that very first impression of a good quality renovation. Everything about it, including the stone and brickwork, bespoke windows, hard landscaping and neatly shaped shrubs conveyed diligent care and flawless taste.

This recipe is one that will appeal in any market. An exceptionally good house, placed in a peaceful rural location with far reaching views and nothing to blight it. That combination of location and quality was irresistible to those who viewed Field House and within days of competitive bidding, a sale was agreed at a healthy premium to a delighted buyer.

It was the end of the summer holidays in late August that signalled a wind of change in the mainstream and country house markets. For the first 8 months of 2022 the housing market remained incredibly buoyant with significant viewing numbers, buyers readily competing fiercely for desirable properties and “best offers” remaining common place.

The now infamous “mini budget” saw banks rush to increase mortgage rates incredibly quickly, which immediately started to filter into the market. It is clear that the days of ultra-low interest rates are behind us and we will need to adjust to the new norm.

We remain positive for the market locally and history tells us that if there are falls then this area is likely to fall much less than other parts such as the south east. The outlook for the market and pricing will ultimately depend on how the economy performs and what happens to interest / borrowing rates as a result.

We continue to see healthy levels of demand from good quality buyers. The upside for them is that in this more balanced market they will have a little extra time to make buying decisions compared with the frenzy of the post covid era. Deals continue to be agreed with a few off-market sales too; but as we move towards the year end some will use this time for watching & waiting, although if the right thing comes up don’t wait too long !

We now look for a few months of stable government and anticipate the market gathering momentum in the new year. If you are looking to sell or buy, then please don’t hesitate to get in touch – we would be delighted to help.

CS Nov 22.

Until this summer it had been the understanding for many years in the property industry that houses with an indoor swimming pool had a positive advantage and having one could help sell a home as well as adding to its value. In contrast, an outdoor pool did not add any more to the sale price and indeed, for some buyers have been regarded as a detrimental feature. This has changed!

2018 has been one the hottest and driest summers known with records constantly being broken and temperatures regularly reaching 30C. With the heatwave set to continue, house buyers are positively seeking homes with pools, whether they are inside or out. However, with the continuing shortage of village property on the market, finding one is not easy despite it being estimated that there are over 200,000 homes in the UK with a swimming pool.

There is a lot to take into consideration when installing a swimming pool not least of which is the cost and this can vary enormously depending on what ground works are required and whether it’s an above ground, below ground or housed. Then there’s the type of pool to think about from a traditional design, an infinity pool or a natural swimming pond as well what they are made of and whether there are to be any additional features like diving boards, pressure jets or water cascades.

Another important factor is how the water is to be managed, cleaned, filtered, covered and heated. One also has to take into account where in a garden a pool is going to be sited and ideally this will be in a sunny but sheltered spot. Safety needs to be taken into consideration, particularly where there are young children around, so it is sensible to have fencing with secure access.

Size matters. Most people want a pool which is large enough to have some fun splashing around in and to be able to swim a few lengths rather than one that is no bigger than a paddling pool to cool down in on a hot day but it should not be so large that it completely dominates the garden.

Rural View are marketing a village property in an exclusive residential road on the Isle of Wight that boasts having a particularly good-sized pool (55 x 28 ft). Lamorna is an extended detached house built in the 1960’s with a large garden and is being marketed as a refurbishment or redevelopment opportunity. The guide price is £1.1 million and should a new owner fancy swimming in the sea rather than the pool, then the beach is just a short stroll away.

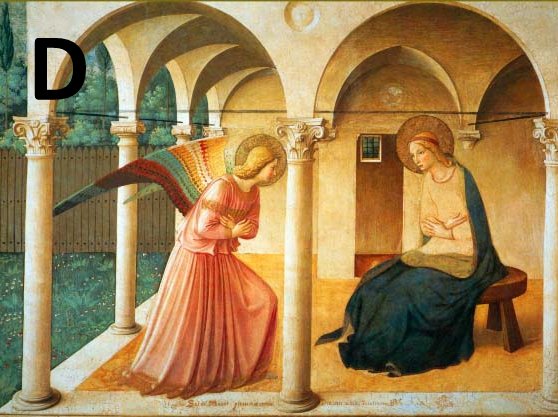

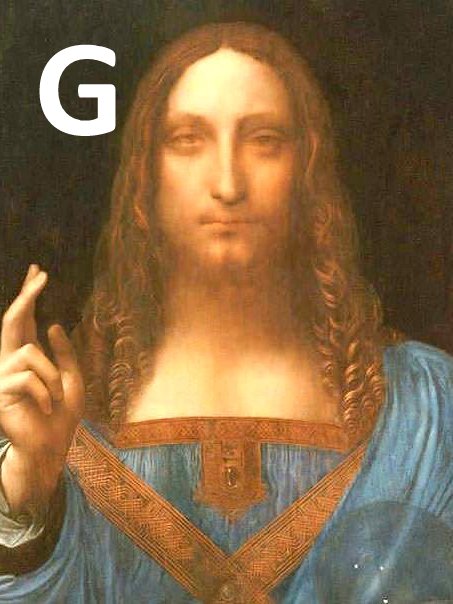

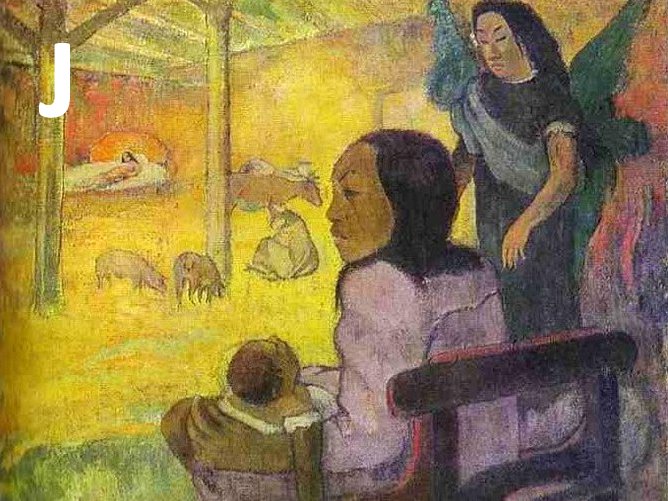

Here are 10 winter & Christmas scenes, some are more familiar than others but who painted them? Name as many artists as you can!

1st Prize – 12 Bottles of Wine

2nd Prize – 6 Bottles of Wine

TIE BREAK – How much was Picture G sold for at auction in 2017?

Email your answers & contact details to: admin@ruralview.co.uk

or send them to Rural View, Unit 5, Manor Farm, Chilmark, Salisbury SP3 5AF

CLOSING DATE – Tuesday 2nd January 2018

For full competition rules email admin@ruralview.co.uk

From village fetes to westminster…

One of the benefits of English country living and village life vs living in the city, is being part of the local community. Known as country estate agents specialising in selling rural homes and country lettings in Wiltshire, Dorset and Hampshire, Rural View conduct their business with this very much in mind.

Over the years we have been involved in backing a diverse range of local events. This has including supporting a number of village and church fetes including those in Chilmark, Donhead St Andrew and East Knoyle as well as the Damerham Firework display and the Deverills Festival, a wonderful week of art, drama, comedy and music based in the Deverill Valley.

As a fund raiser for the parish churches in Chilmark and Dinton, in April 2015 Rural View sponsored an extremely interesting talk chaired by BBC South’s former political editor Bruce Parker in a packed Dinton Village Hall. The guest speakers were Sir Peter Jennings, a retired House of Commons Serjeant at Arms and Sir George Young who held a variety of senior cabinet posts in several Conservative governments. They discussed their take on life in Parliament, revealing a fascinating peek inside the World of British politics and the Palace of Westminster.

Our next sponsored event will be the very popular and spectacular Chitterne Firework Display on Sunday 1st November which is free entry.

We intend to continue being involved in village life, promoting and backing worthwhile local causes and community events and can be contacted on 01722 716895 or via our website; www.ruralview.co.uk to discuss any ideas or proposals.